OneWeb has filed for bankruptcy and intends to sell its business, bringing an abrupt end to the company's plan to offer high-speed satellite Internet service around the world.

OneWeb announced Friday that it "voluntarily filed for relief under Chapter 11 of the [US] Bankruptcy Code," and "intends to use these proceedings to pursue a sale of its business in order to maximize the value of the company." OneWeb made the decision "after failing to secure new funding from investors including its biggest backer SoftBank," largely because of the coronavirus pandemic, the Financial Times wrote. OneWeb also "axed most of its staff on Friday," the FT article said.

OneWeb previously raised $3 billion over multiple rounds of financing and was seeking more money to fund its deployment and commercial launch. "Our current situation is a consequence of the economic impact of the COVID-19 crisis," OneWeb CEO Adrián Steckel said in the bankruptcy announcement. "We remain convinced of the social and economic value of our mission to connect everyone everywhere."

The bankruptcy announcement came a week after OneWeb said it expected "delays to our launch schedule and satellite manufacturing due to increasing travel restrictions and the disruption of supply chains globally."

OneWeb was founded by Greg Wyler in 2012 and was originally known as WorldVu. OneWeb "said it laid off about 85 percent of its 531 employees prior to filing for bankruptcy," SpaceNews wrote Friday. OneWeb's bankruptcy filing shows it has "$2.1 billion in total liabilities, including $1.7 billion in senior secured financing plus money owed to between 1,000 and 5,000 creditors," SpaceNews wrote.

OneWeb is a UK-based company and has its US headquarters in McLean, Virginia. OneWeb also operates a satellite-production factory in Florida in a joint venture with Airbus. After SoftBank, OneWeb's top shareholders were Qualcomm, Wyler's 1110 Ventures LLC, and Airbus.

OneWeb has “valuable global spectrum”

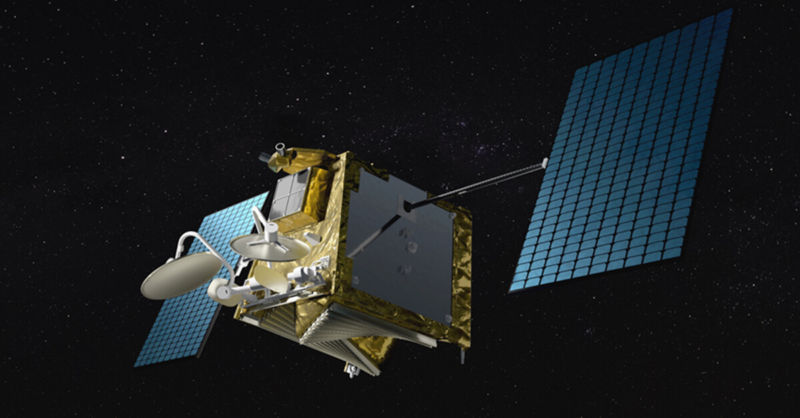

OneWeb had already launched 74 satellites and demonstrated broadband speeds of more than 400Mbps with latency of 32ms. The company was a key competitor to SpaceX's Starlink division, which has launched 362 satellites and plans to launch thousands more. The satellites of both OneWeb and SpaceX operate in low Earth orbits, allowing them to provide much lower latency than traditional geostationary satellites.

OneWeb at one point was ahead of SpaceX in the satellite race, having secured Federal Communications Commission approval in June 2017, before SpaceX did. OneWeb planned to serve the United States and global markets from "720 low-Earth orbit satellites using the Ka (20/30GHz) and Ku (11/14GHz) frequency bands," the FCC noted at the time.

OneWeb's bankruptcy announcement noted that it owns the rights to "valuable global spectrum," which may entice a buyer. OneWeb said it has also "begun development on a range of user terminals for a variety of customer markets, [and] has half of its 44 ground stations completed or in development." The current deployment of 74 satellites is "too small to offer telecoms services or generate revenues," the Financial Times wrote.

Potential buyers could include Amazon or Facebook, which are both planning constellations of low-Earth-orbit broadband satellites. (Amazon founder and CEO Jeff Bezos in February sold $4 billion in Amazon stock, giving him plenty of cash on hand.) Space Norway and Telesat also have low-Earth satellite plans.

OneWeb said it has "seen significant early global demand... from governments and leaders in the automotive, maritime, enterprise, and aviation industries." But investors' willingness to fund the company evaporated in the midst of the pandemic, OneWeb explained:

Since the beginning of the year, OneWeb had been engaged in advanced negotiations regarding investment that would fully fund the company through its deployment and commercial launch. While the company was close to obtaining financing, the process did not progress because of the financial impact and market turbulence related to the spread of COVID-19.

SpaceX CEO and founder Elon Musk recently discussed the challenges of starting a low-Earth-orbit satellite business, saying his goal is to have Starlink end up "in the not-bankrupt category."

reader comments

153