A birdseye view of SES headquarters, Chateau de Betzdorf, in Luxembourg. (SES handout)

WASHINGTON — The planned $3.1 billion purchase of US satellite communications behemoth Intelsat by Luxembourg-based SES will bring together two of the largest operators of geosynchronous Earth orbit (GEO) satellite communications networks — as traditional players scramble to shore up market share in the face of stiff competition from mega-constellations in lower orbits.

“I think we are seeing more waves from the shakeup in the commercial SATCOM market due to Starlink and OneWeb with their lower costs and higher capacity LEO [low Earth orbit] broadband services. The traditional incumbents are being challenged in a major way for the first time in a long time,” said Todd Harrison, a space industry expert and senior fellow at the American Enterprise Institute.

For example, in 2021 Viasat announced its planned buy of UK SATCOM operator Inmarsat, which was concluded in May 2023. France’s traditional telecom giant Eutelsat in September 2023 finalized its 2022 bid for UK operator OneWeb and the latter company’s LEO constellation of more than 600 satellites.

“And we should expect more disruptions to this market in the next couple of years as Amazon begins deploying its Kuiper constellation,” Harrison added.

A Falcon 9 rocket launches a satellite designated as INTELSAT G33-G34 from Space Launch Complex 40 at Cape Canaveral Space Force Station, Fla., Oct. 8, 2022. (U.S. Space Force photo by Joshua Conti)

In announcing its acquisition of Intelsat, which is headquartered here in Washington, D.C., SES CEO Adel Al-Saleh today called the deal a “transformational agreement.”

“In a fast-moving and competitive satellite communication industry, this transaction expands our multi-orbit space network, spectrum portfolio, ground infrastructure around the world, go-to-market capabilities, managed service solutions, and financial profile,” he said.

Intelsat CEO David Wajsgras added: “By combining our financial strength and world-class team with that of SES, we create a more competitive, growth-oriented solutions provider in an industry going through disruptive change.”

Both SES and Intelsat supply SATCOM bandwidth and/or services to the Defense Department through various contract vehicles.

SES, through its US arm SES Space & Defense, last November inked a five-year agreement with the Defense Information Systems Agency (DISA) to provide US armed forces with access to its O3b mPower broadband constellation in medium Earth orbit (MEO) as managed service. Under the soup-to-nuts, subscription-style deal worth up to $270 million, the military services can get connectivity, terminals, support and even training.

Intelsat last September was one of two satellite firms tapped by the US Army for its Satellite Communications (SATCOM) as a Managed Service (SaaMS) pilot, intended to “inform decisions on the Army’s potential use of commercially leased SATCOM services.” DISA also served as the contracting agency.

SES currently has a fleet of 20 first-generation O3b satellites, six new mPower birds in MEO, plus another 50 or so in GEO.

Intelsat has a fleet of 55 satellites in GEO, but it also has a set of partnerships with LEO operators that allowed it to garner one of the now-20 companies competing under a Space Force indefinite delivery/indefinite quantity (ID/IQ) contract for services from large so-called proliferated-LEO, or p-LEO, constellations. The Proliferated Low Earth Orbit (PLEO) Satellite-Based Services ID/IQ vehicle allows vendors to compete for up to $900 million in task orders via Space Systems Command’s SATCOM marketplace.

The combined company, once approved by financial overseers, will be headquartered in Luxembourg but maintain its US operations.

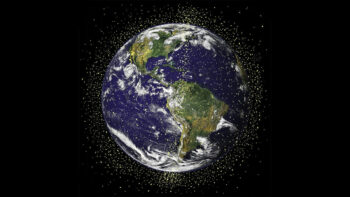

Commerce extends commercial data contracts for space tracking system pilot

All five contractors — COMSPOC, Kayhan Space, LeoLabs, Slingshot Aerospace, and SpaceNav — received new orders, bringing total “spending over the course of the Consolidated Pathfinder to $15.5 million,” according to an announcement by the Office of Space Commerce.